Understanding How Credit History Repair Works to Enhance Your Financial Wellness

Understanding the technicians of debt repair work is crucial for anybody seeking to boost their monetary health. The process includes recognizing errors in credit rating reports, challenging inaccuracies with credit scores bureaus, and bargaining with creditors to address exceptional financial obligations. While these actions can substantially influence one's credit history, the journey does not end there. Developing and preserving sound financial practices plays an equally critical function. The inquiry stays: what specific strategies can people employ to not just remedy their debt standing however also guarantee lasting financial security?

What Is Credit Repair?

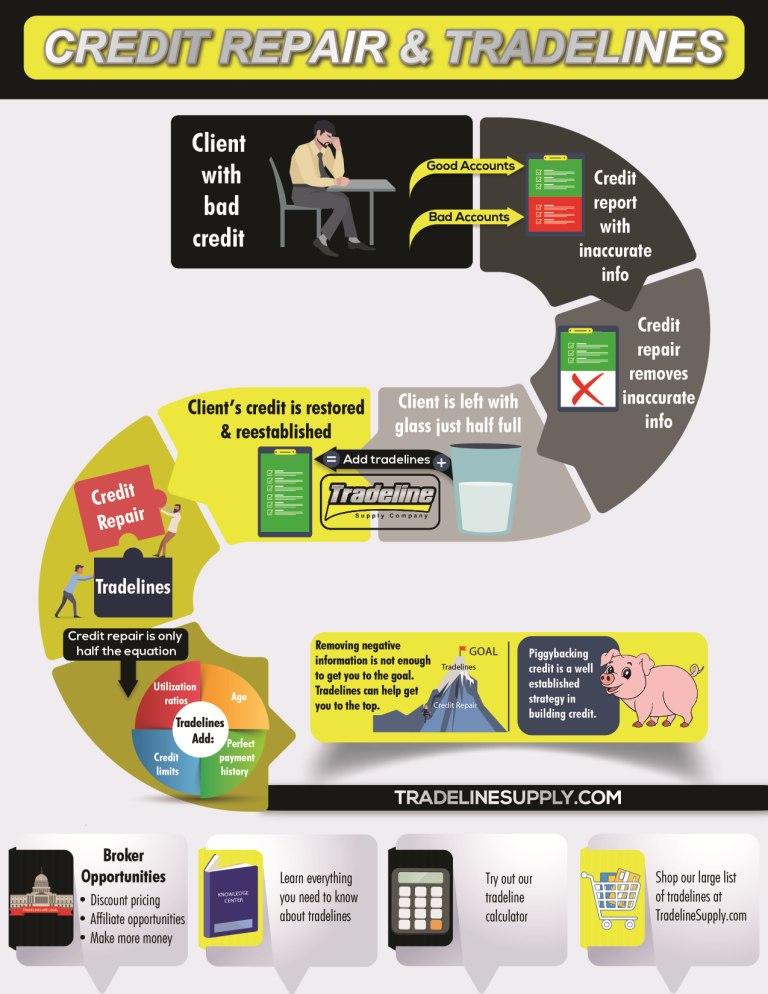

Credit scores fixing describes the procedure of enhancing a person's credit reliability by addressing errors on their credit report, discussing debts, and adopting better financial behaviors. This diverse strategy aims to enhance an individual's credit report, which is an essential aspect in safeguarding loans, bank card, and desirable rates of interest.

The credit rating fixing procedure usually starts with a thorough review of the person's credit rating record, enabling the identification of any disparities or mistakes. Once errors are identified, the specific or a credit repair professional can initiate disagreements with debt bureaus to fix these concerns. Furthermore, working out with lenders to clear up impressive financial debts can better enhance one's financial standing.

Furthermore, adopting prudent economic practices, such as prompt expense settlements, decreasing credit use, and preserving a diverse credit report mix, adds to a much healthier debt profile. On the whole, credit history fixing works as an important approach for individuals looking for to regain control over their economic health and protect much better borrowing possibilities in the future - Credit Repair. By participating in credit scores fixing, individuals can pave the means toward attaining their monetary goals and boosting their total top quality of life

Usual Credit Scores Report Errors

Errors on credit history reports can dramatically influence a person's credit rating, making it vital to recognize the typical kinds of mistakes that might emerge. One prevalent issue is inaccurate individual info, such as misspelled names, wrong addresses, or wrong Social Safety and security numbers. These errors can bring about confusion and misreporting of credit reliability.

Another typical mistake is the reporting of accounts that do not belong to the person, commonly due to identity burglary or clerical blunders. This misallocation can unfairly decrease an individual's credit report. In addition, late payments might be improperly tape-recorded, which can occur due to repayment processing mistakes or inaccurate coverage by loan providers.

Credit limits and account balances can additionally be misstated, leading to an altered view of a person's credit history use ratio. Understanding of these usual mistakes is vital for efficient credit administration and repair, as addressing them quickly can assist people preserve a much healthier financial profile - Credit Repair.

Steps to Disagreement Inaccuracies

Contesting mistakes on a debt record is a vital process that can assist recover an individual's creditworthiness. The initial step involves getting a current duplicate of your credit history record from all three major credit bureaus: Experian, TransUnion, and Equifax. Testimonial the record thoroughly to determine any type of errors, such as wrong account information, balances, or settlement backgrounds.

Next off, start the dispute process by speaking to the appropriate credit bureau. When submitting your dispute, plainly lay out the inaccuracies, supply your evidence, and include personal recognition info.

After the dispute is filed, the debt bureau will check out the insurance claim, generally within 1 month. They will certainly connect to the lender for confirmation. Upon completion of their investigation, the bureau will certainly inform you of the end result. If the conflict is dealt with in your favor, they will deal with the record and send you an updated duplicate. Maintaining precise documents throughout this process is important for effective resolution and tracking your credit score wellness.

Structure a Strong Credit History Account

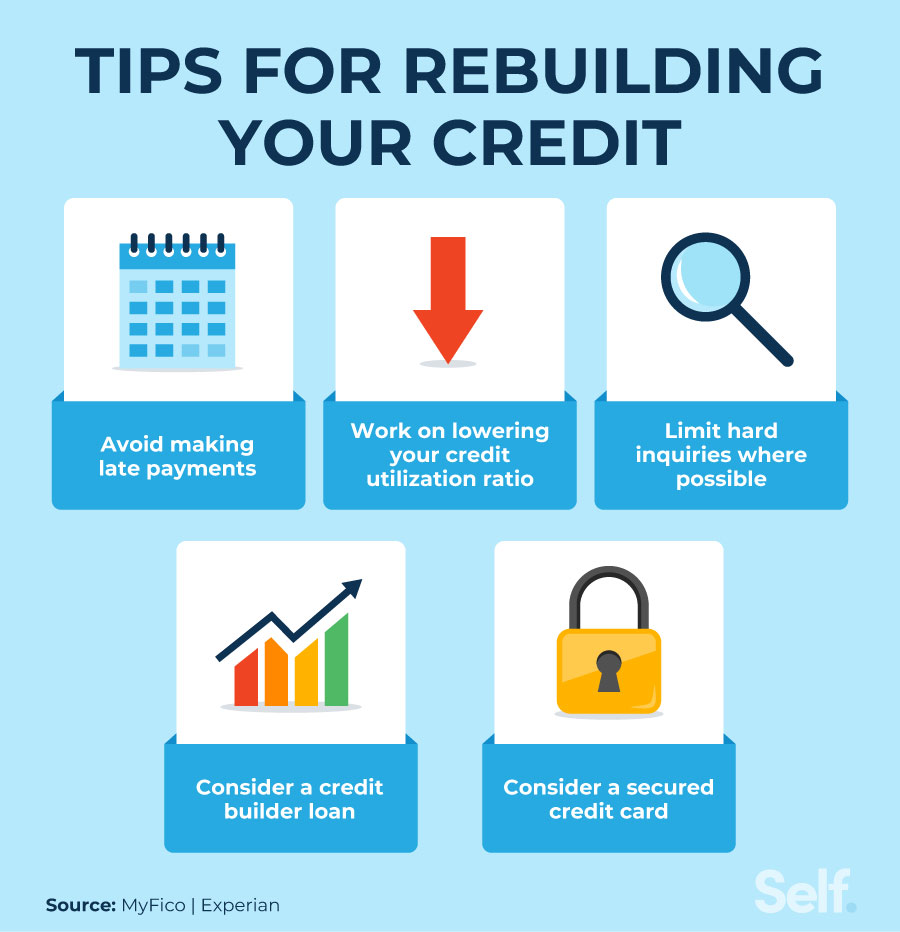

Exactly how can people Continued effectively cultivate a robust credit rating profile? Constructing a strong credit history profile is vital for securing beneficial monetary opportunities. The structure of a healthy credit score profile begins with timely bill settlements. Regularly paying charge card costs, lendings, and various other commitments on schedule is essential, as payment background dramatically influences credit rating scores.

Moreover, preserving low credit application ratios-- preferably under 30%-- is vital. This means keeping credit history card equilibriums well listed below their restrictions. Branching out credit rating types, such as a mix of rotating credit report (bank card) and installation finances (car or mortgage), can also improve credit profiles.

Routinely keeping track of debt records for errors is just as vital. Individuals should assess their debt reports at the very least each year to determine inconsistencies and dispute any kind of mistakes quickly. Furthermore, avoiding extreme credit score questions can prevent potential unfavorable effect on credit report.

Lasting Advantages of Credit Report Repair Work

In addition, a more powerful credit account can help with better terms for insurance coverage costs and also influence rental applications, making it simpler to secure housing. The emotional benefits should not be overlooked; people who successfully fix their debt usually experience minimized tension and boosted self-confidence in managing their finances.

Final Thought

In verdict, credit fixing functions as a crucial device for improving economic wellness. By determining and disputing errors in credit scores reports, individuals can fix errors that negatively affect their credit history. Developing audio monetary practices even more adds to constructing a durable debt account. Inevitably, effective credit rating repair service not just facilitates accessibility to better loans and reduced passion prices yet additionally promotes lasting economic stability, thereby promoting overall financial wellness.

The lasting advantages of debt repair expand far beyond just enhanced credit scores; they can significantly boost an individual's general monetary health and wellness.

Comments on “Change Your Monetary Future with Expert Tips on Credit Repair”